kansas sales tax exemption certificate

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. ST-28F Agricultural Exemption Certificate Rev.

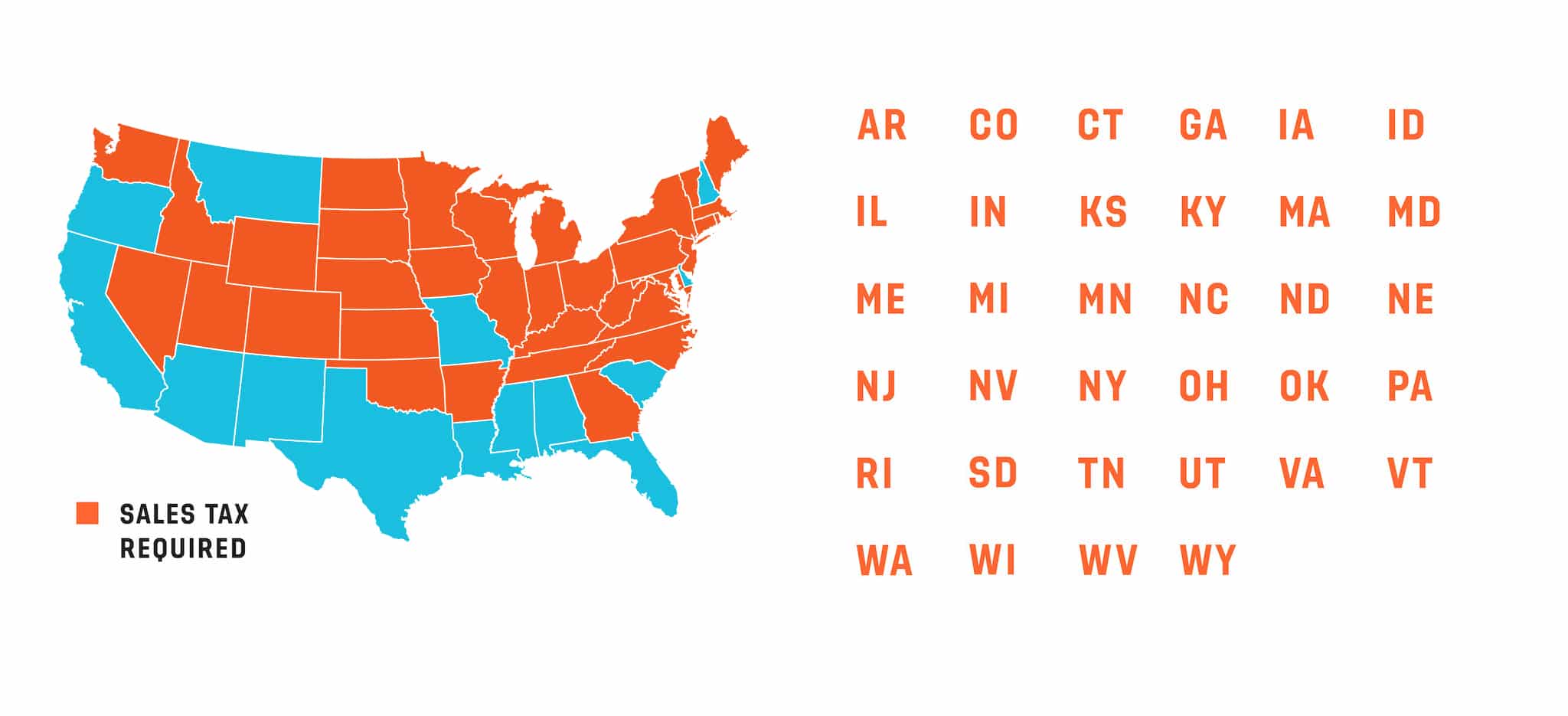

How Do I Submit A Resale Certificate Or Tax Exemption Certificate Printful Help Center

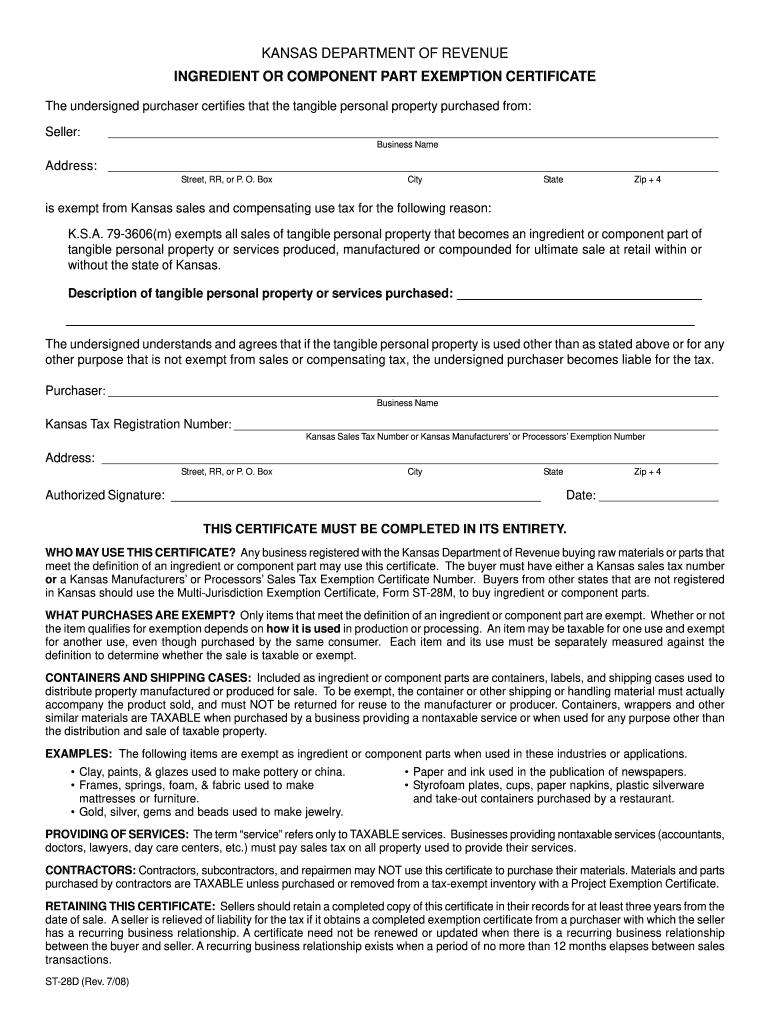

79-3606fff exempts all sales of material handling equipment racking systems and other related.

. If you are accessing our site for the first time. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. This is a multi-state form for use in the states.

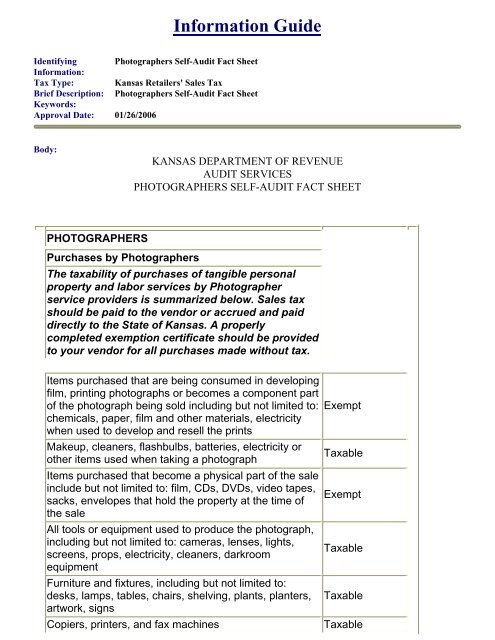

1 Exemption Certificates Pub KS-1520 Rev. The certificates will need. Most exemption certificates are usually infinitely valid so long as there is a continuing business relationship between the.

Are exempt from Kansas sales and compensating use tax for the following reason. Burghart is a graduate of the University of Kansas. Homeland Security TrainingIS 700.

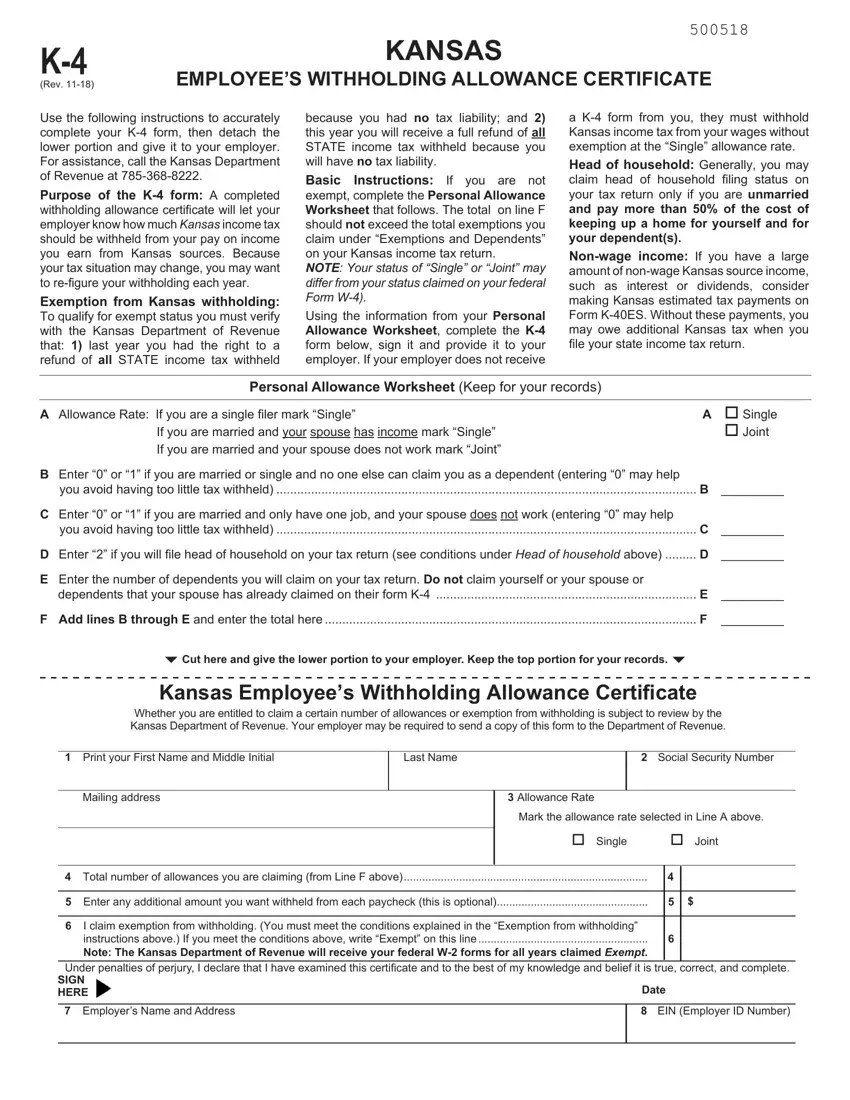

Your Kansas Tax Registration Number 000-0000000000-00. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Destination-based sales tax information.

A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. File withholding and sales tax online. All construction materials and prescription drugs including prosthetics and.

The retail sale of a work-site utility vehicle may be exempt from Kansas sales tax if it meets all statutory requirements. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Streamlined Sales Tax Certificate of Exemption Do not send this form.

11-15 properly use Kansas sales and use tax. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the. Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire.

KDA HQ Emergency Evacuation Plan. This exemption certificate is used either to claim a sales and use tax-exemption present in Kansas law not covered by other certificates or by a non-Kansas tax-exempt entity not in. Real Property Tax Exemption Sales Tax Exemption for construction remodel equipment and furnishings Tax Exemptions via Industrial Revenue Bonds Utilities Consumed in Production.

1115 This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. You can download a PDF of.

Kansas Department of Revenue Home Page. How long is my Kansas sales tax exemption certificate good for. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a.

Information Guide Photographers Self Audit Fact Sheet Kansas

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Departmentof Revenue Fill Out Sign Online Dochub

Kansas To Seek Sales Tax Revenue From Unregistered Remote Sellers

Kansas City Business Tax Registration

Sales Tax Exemption Form Carrico Implement Kansas John Deere Equipment Dealer

Tax Exempt Certificate Kansas Fill And Sign Printable Template Online

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Kansas State Form W 4 Download

Who Fills Out Kansas Department Of Revenue For Pr 74a Form 2005 2022

Fill Free Fillable Kansas Department Of Revenue Pdf Forms